When it comes to the housing market, the decisions made by the Federal Reserve (the Fed) can have a significant impact on your plans to buy a home. Understanding how inflation and the Federal Funds Rate affect mortgage rates is crucial for homebuyers. Let's dive into the details.

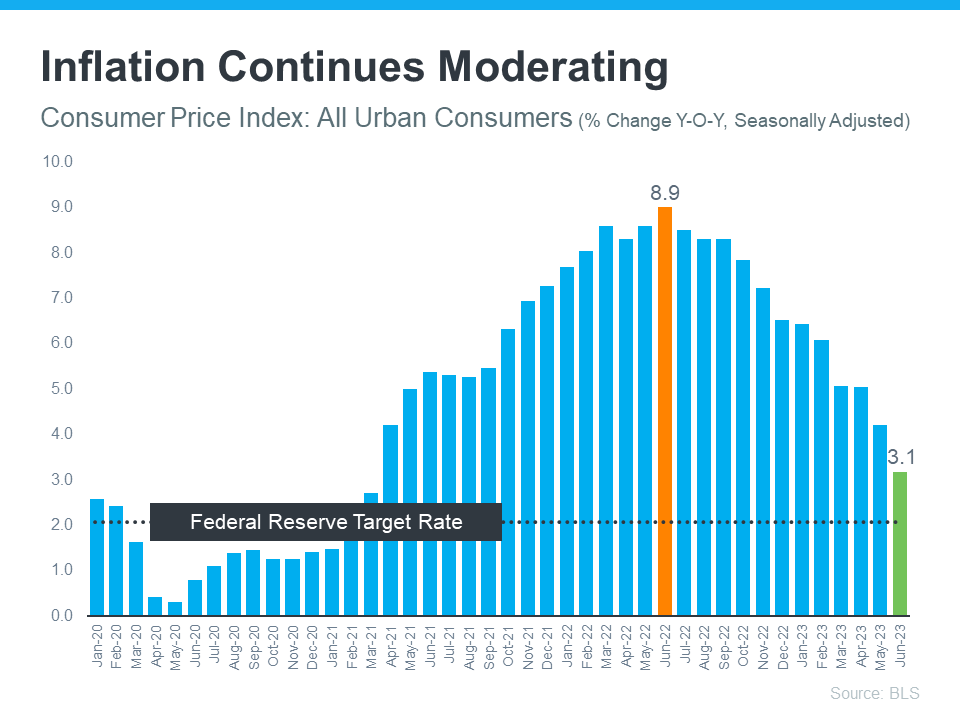

Inflation Remains a Key Factor:The Fed is actively working to reduce inflation, but recent data shows that it is still higher than the desired 2% target. Despite 12 consecutive months of cooling inflation, the Fed decided to increase the Federal Funds Rate to prevent inflation from climbing back up. This decision has implications for mortgage rates.

The Connection between Fed Rates and Mortgage Rates: While the Federal Fund Rate doesn't directly dictate mortgage rates, it does influence borrowing costs. When inflation is high, the Fed raises rates to slow down the economy. Conversely, when inflation is low, they lower rates to stimulate economic growth.

Impact on Mortgage Rates: In simple terms, when inflation is high, mortgage rates follow suit, making homeownership more expensive. However, if the Fed's efforts successfully bring down inflation, it could lead to lower mortgage rates, making homeownership more affordable.

The Future of Mortgage Rates: Historical trends suggest that as inflation decreases, mortgage rates tend to go down as well. As inflation pressures ease, we can expect more consistent declines in mortgage rates throughout the year. This would be beneficial, especially if the economy and labor market show signs of slowing down.

The relationship between inflation, the Federal Funds Rate, and mortgage rates is critical for prospective homebuyers to understand. As inflation cools down, mortgage rates are likely to follow suit. If you're considering buying a home, let's discuss how these factors impact your plans and how you can make the most of the current market conditions.

- Enhancing Property Appeal: The Role of Auto Detailing in Real Estate

- Why You Should Work with a Real Estate Agent

- Unlocking the Advantages of First-Time Homeownership in Chicago's O'Hare Region

- Unlocking Long-Term Gains: The Value of Owning a Home in the Chicago Area

- Why Your Chicago Home Didn't Sell: Insights and Solutions