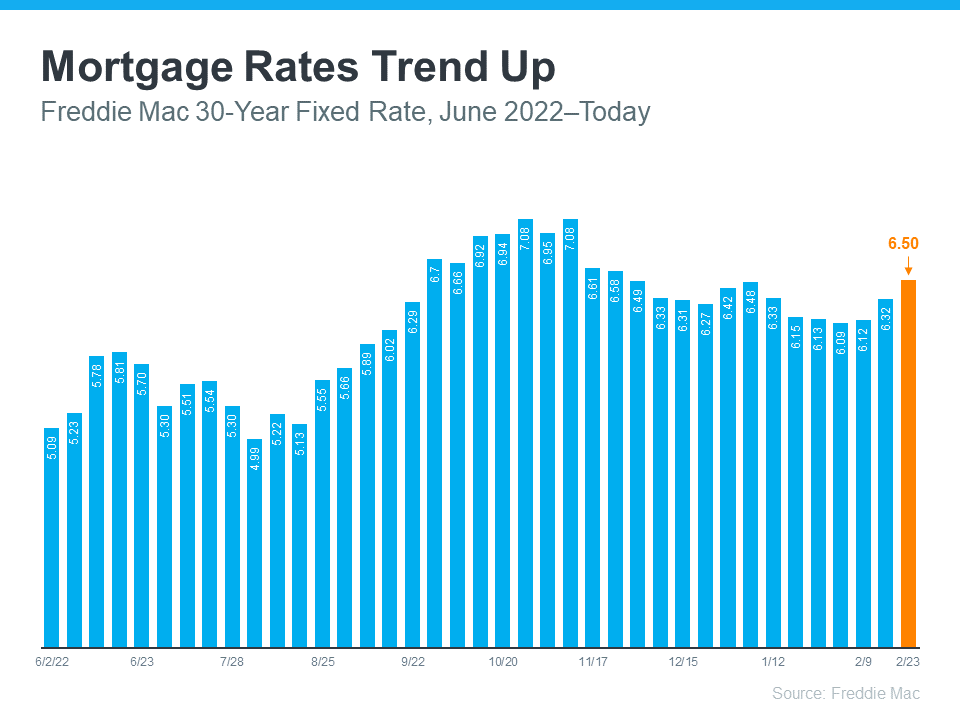

The recent increase in mortgage rates has left potential homebuyers wondering whether it’s the right time to buy a home or if they should wait for rates to drop again. After falling over the winter, mortgage rates have started to rise due to inflationary pressures. The most recent average 30-year fixed mortgage rate reported by Freddie Mac is at its highest point this year, which has caused some potential homebuyers to pull back on their search.

However, this could actually be an opportunity for home shoppers. If you continue your search during this time of rising rates, you may face less competition among other buyers. This is good news in a market that has few homes available for sale.

Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association (MBA), explains that the recent uptick in rates is driven by market expectations that inflation will persist, thus requiring the Federal Reserve to keep monetary policy restrictive for a longer time.

So, if you’re planning to purchase a home this year, don’t let rising mortgage rates deter you. Instead, take advantage of the opportunity to buy the home you’ve been searching for with less competition from other buyers. Connect with a real estate agent today to explore your options in the local market.

- Enhancing Property Appeal: The Role of Auto Detailing in Real Estate

- Why You Should Work with a Real Estate Agent

- Unlocking the Advantages of First-Time Homeownership in Chicago's O'Hare Region

- Unlocking Long-Term Gains: The Value of Owning a Home in the Chicago Area

- Why Your Chicago Home Didn't Sell: Insights and Solutions