Happy Valentine’s Day

|

|

Buying Is Better Than Renting in Most Markets... but for How Long?

|

Monday Motivation by John Castelli

Happy Monday! I hope you had an amazing weekend! As always I like to start the week off right with some words of inspiration...

Monday Motivation by John Castelli

Happy Monday! I hope you had an amazing weekend and are ready for a great week ahead!

In the market for a new home? Here are your best bets.

SPECIAL REPORT

Monday Motivation by John Castelli

Happy Monday! I hope you had an amazing weekend and are set for a MASSIVE week!

Preparing Your Home to be SOLD!!

Preparing Your Home to be SOLD!!

Monday Motivation by John Castelli

Happy Monday! I hope you had an amazing weekend!

As always I like to start the week off right with some words of motivation....

"DISCIPLINE: The One Thing Necessary To Achieve Any Goal Worth Having"

Monday Motivation by John Castelli

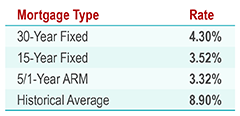

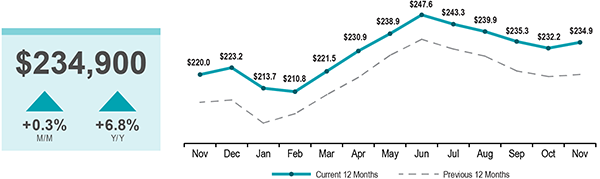

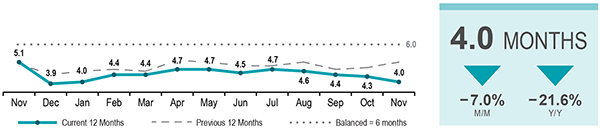

This Month in Real Estate - January 2017

|